Our merger was finalized and Parkside Credit Union officially joined TRUE Community Credit Union on January 1.

Throughout the coming months, we will be communicating important information pertaining to the next phase of our merger process, which is the account transition. The System Synergy icon will be displayed on all materials related to this process.

{beginAccordion h2}

System Synergy General Information

Q: What does System Synergy mean?

As a last step in the merger process, we will need to complete the account transition bringing our credit union systems together. System Synergy refers to the weekend when we bring all accounts together to one software program!

Q: When will this happen?

Friday, May 31 (5pm) through Sunday, June 2.

Q: What is my branch availability?

Now through May 31 at 5pm:

You will be able to conduct transactions at the Westland, Livonia, and Dearborn branches.

Saturday, June 1:

The Westland, Livonia, and Dearborn branches, as well as the Contact Center, will be closed.

Monday, June 3:

The Westland, Livonia, and Dearborn branches re-open with ALL accounts fully integrated as one TRUE Community Credit Union family. You will now have access to 12 additional branches located in Jackson, Ingham, and Washtenaw counties. Check them out here: Locations & Hours | TRUE Community Credit Union | Jackson, Mason, Brooklyn - MI (trueccu.com)

Q: Will I have access to my funds during the Account Transition?

Yes, you can use your debit card and checks during the Account Transition weekend May 31-June 2. Any branch transactions must be completed prior to close of business on Friday, May 31.

Q: What’s going to happen with my Parkside Points?

You will retain your Parkside Points and they will transfer to TRUE Reward Points! You can view and redeem your TRUE Rewards points online or via the mobile app!

Direct Deposit/Direct Withdrawals

Q: Will my direct deposits and automatic payments be posted DURING the account transition?

Yes. Direct deposits (including payroll, social security, or other regular deposits) and automatic payments will be posted and processed as usual.

Q: What is the new routing number?

The new routing number is 272481583. You’ll begin using this routing number June 3! This 9-digit number acts as a director to send your deposits and withdrawals to TRUE so it is an important number! When you order new checks (after June 3), the new routing number is the 9-digit listed at the bottom. You can also find the routing number listed on the homepage of our website, TRUECCU.com.

Q: Do I need to update the routing number for my existing deposits and withdrawals?

Yes! On June 3, please begin updating your routing number for deposits and withdrawals in your account. The previous routing number will be honored for a time, but there may be a delay in posting, so the sooner this is updated, the faster your incoming and outgoing transactions will post!

Debit and Credit Cards

Q: Will I be able to use my existing debit card during the System Synergy weekend?

Yes, you’ll continue to use your existing cards May 31-June 2; however they will have a daily limit. We recommend withdrawing additional cash for making purchases throughout the System Synergy weekend in case you exceed your daily card limit.

On Monday, June 3, you’ll activate the new TRUE cards sent to you by mail. To do this, call the phone number on the card mailer, activate the card(s), and select your PIN.

Q: Will I get new debit and credit cards?

Yes! You’ll receive new cards in the mail PRIOR to June 3. Hold on to them because you will activate and begin using them on Monday, June 3. To activate and select your PIN, you’ll call the number enclosed in the mailer.

Q: Will I be able to use my existing credit cards during the System Synergy weekend?

Yes! You will be able to use your existing Parkside credit card through June 2.

On Monday, June 3, you’ll activate the new TRUE cards sent to you by mail. To do this, call the phone number on the card mailer, activate the card(s), and select your PIN.

Q: Will I get to choose my PIN for my new cards?

Yes!

Q: Will I need to go to a branch to change my PIN on my new cards?

No. This can be done conveniently by phone 24/7.

Loans and Insurance

Q: Who should the lienholder be on my title?

Beginning January 1, 2024, the lienholder listed on your title is:

TRUE Community Credit Union

1100 Clinton Rd.

Jackson, MI 49202

Q: My insurance needs my lienholder information. What do I tell them?

Beginning January 1, 2024, the lienholder listed on titles and insurance is:

TRUE Community Credit Union

1100 Clinton Rd.

Jackson, MI 49202

Q: How will my loan report on my credit report now?

You’ll see a change in the financial institution on your credit reports. The name of the credit union has been updated to TRUE Community Credit Union (FKA Parkside CU) or TRUE COMMUNITY C2456. Either of these is accurate.

In January and February 2024, there were some delays in payments reporting to the credit bureaus (Trans Union, Equifax, and Experian). As of 3/20/24, each credit bureau is accurately reporting our correct name, TRUECCU, and payment history data is displaying accurately. Thank you for your patience as we resolved this problem.

Q: How do I do skip-a-pay?

During the month of May, the skip-a-pay option will not be available. Please call us if you’re experiencing a financial hardship for other options.

Q: Can I do a skip-a-pay on my credit card?

As of June 2024, we will no longer be able to process skip-a-pays for credit cards.

Business Checking Accounts

At TRUE, we offer a variety of Commercial Services, ranging from Commercial Checking packages to Micro Business and Commercial Loans. Over 2,000 businesses have partnered with us to grow and manage their financial business needs. We have a dedicated Commercial Services team that can help be your partner in cultivating legacy-defining moments for your business now and into the future! Contact our Commercial Services Department at [email protected].

Q: Will there be any changes with my business checking account?

The fee disclosure you will receive by mail reflects our business checking. As a valued legacy Parkside member, your account will transition to our Neighborhood Checking account, which has no monthly fee and unlimited transactions!

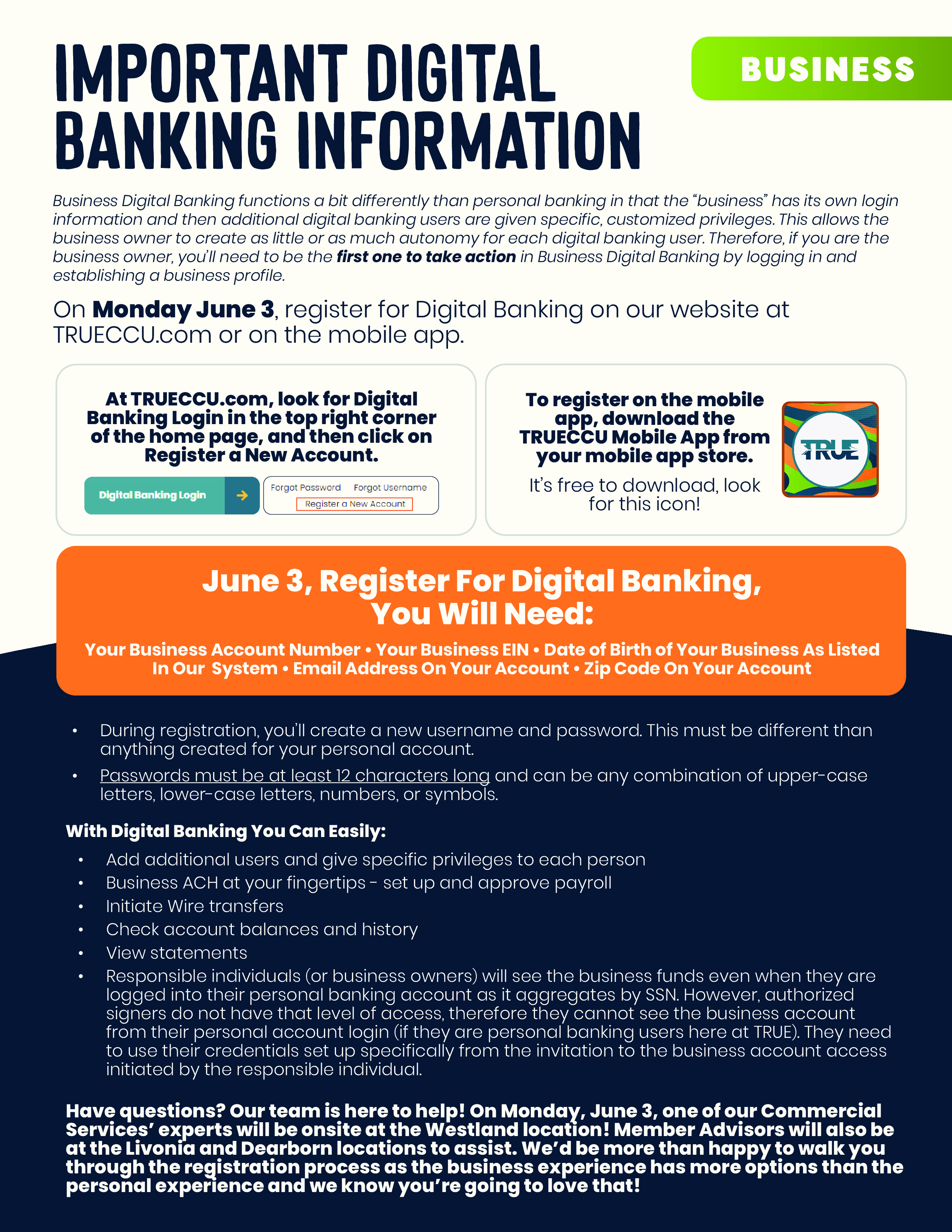

Online/Mobile Access (Digital Banking)

Q: How will the conversion weekend impact my online/mobile banking?

Online access will not be available May 31 (5pm)-June 2. On Monday, June 3, there will be a new Digital Banking platform that you will access.

Q: Will my online banking access change?

You will continue to use the mobile app or online banking from ParksideCU.org until Friday, May 31 at 5pm. Online access will not be available May 31-June 2. June 3, there will be a new Digital Banking platform that you will access. Lots more details to come!

Some features of the new Digital Banking are:

- Zelle (available for personal accounts)

- Set up alerts

- Free credit score and credit monitoring (SavvyMoney)

- Card Updater (connect any bills you pay with your debit card in Card Updater so that if your debit card number changes, you can update this in just one place, and it will automatically update the card number with all of the bills you’ve connected!)

- View account information

- Transfer funds between accounts

- Access e-Statements

- Make loan payments

- Pay bills

- View pending transcations

- Order checks

Q: Will mobile deposit be available during the account transition?

No, the mobile deposit feature will be unavailable during the account transition weekend May 31-June 2. After the transition, mobile deposit will be available on a different platform through the TRUE app. You will download the TRUE app from the App Store or Google Play. Look for this icon:

Q: How do I view my eStatement in the new Digital Banking system?

Go to “Accounts” > “eDocuments.”

This is where you’ll will see your tax information, statements, and digital newsletter.

Q: How many months of statement history will be available in Digital Banking after the System Synergy?

18 months of historical statements will be available in Digital Banking.

Q: Will my Bill Pay transfer over to the new online banking?

Yes! Your full Bill Pay Profile including Payees and Scheduled Payments will be moved over to TRUECCU Digital Banking for your convenience. You will continue to schedule and make payments via Bill Pay all the way until May 31 at 5pm. Then system synergy takes place! Monday, June 3, you’ll register for the new Digital Banking! After you register, please allow our team one business day to transfer the Bill Pay information!

When you click on “Bill Pay,” there will be a message indicating that we are working our fairy dust to move your Bill Pay information from the former system to the new one! Once the magic has taken place, your full Bill Pay profile will have transferred!

Because this is the same Bill Pay profile, your scheduled payments remain the same and will go out as previously requested. This will even take place if you don’t register for Digital Banking right away. Your payments will still go out!

So, what will happen? Let’s say you register for Digital Banking June 3!

June 3: Register for Digital Banking (wait for the magic fairy to move your bill pay profile)

(24 hours later)

June 4: Navigate to Bill Pay within Digital Banking and voila! Your history is there, your payments are there, and you are ready to continue being a boss at your finances!

Q: How can I make transfers in and out of TRUE?

All the following options are available inside of Digital Banking!

Transfers within TRUE:

TRUE Member to TRUE Member

External transfers:

Zelle (inside the Mobile App for personal accounts only)

External ACH (Your account here to or from your account at another financial institution)

Bill Pay ($$ leaving TRUE only)

Web Pay ($$ coming into TRUE)

Q: What's the best way for me to send funds to another person?

We have a few options listed above, but our personal favorite is to use Zelle if you have a personal account! (Business accounts don’t have Zelle.) You can find Zelle inside of the Mobile App in the Transfer & Pay area. Choose Zelle! The system will send you a text message to verify that it’s you. Don’t share this with anyone else! You’ll enter it into the message area inside of Zelle to confirm that the sender is you and you’ll be able to proceed sending funds to any contact in your cell phone. Be careful! As soon as the funds are sent, they’re gone, so be sure that you’re sending it to the correct contact in your phone and that this a close friend or family member who you trust. If Zelle doesn’t meet your needs, stop by a branch, or give us a call, we have options!

Q: What are the differences with mobile check deposit?

Mobile deposit in the new digital banking makes deposits 2x/day. Deposits made before 10 am Monday-Friday will be deposited after 11am that same day. Deposits made between 10am-3pm Monday-Friday will post at 4pm that same day. Deposits made after 3pm during the week will be available at 11am the next business day. Mobile deposits made on holidays and weekends will post to the account the next business day around 11am. Here are some examples!

-Mobile deposit made Monday at 8am, check will post to account around 11am

-Mobile deposit made Monday at 2pm, check will post to account around 4pm

-Mobile deposit made Monday at 4:30pm, check will post to account Tuesday around 11am

-Mobile deposit Monday at 9pm, check will deposit Tuesday around 11am

Business Digital Banking

Mortgage Information

Q: How will I access my mortgage information after the System Synergy?

Your mortgage information will reside directly with your mortgage provider. This will be the BEST way to access accurate, up-to-date information about your mortgage. You may be with Member First Mortgage or Mortgage Center. The websites are listed here! You will log into the one that is appropriate for you.

Member First Mortgage: memberfirstmortgage.com (866.898.1818)

Mortgage Center: mortgagecenter.com (800.353.4449)

Successful Account Transition Tips

*Carry some extra cash May 31-June 2.

We're working on making this transition as seamless as possible! Though your debit cards will be available to use, there will be some limits. To keep your weekend plans running smoothly, it would be wise to carry some extra cash and an additional method of payment just in case!

*By June 3, you will receive your new cards, put them directly into your wallet!

When you receive your new debit and/or credit cards by June 3, place them right in your wallet so you have them in hand when it’s time to use them! You’ll activate and begin using your cards Monday, June 3!

*Update your email, phone number and address with us!

You can check and update your information one of 3 ways:

-Check your information and make changes in online banking

-Call us at 734.525.0700

-Visit us at the Westland, Livonia, or Deaborn branches

*Remember to check your email address, phone number, and mailing address!

*Only order 1 box of checks at a time.

If you need to order checks, we recommend ordering just one box with the existing routing number and account number. There will be a new routing number beginning June 3, so if you can wait until then to order new checks, that would be ideal. (Existing checks will be valid until 12/31/24.)

*Retrieve your account history for good measure!

If you use online banking for tax time and haven’t filed your taxes yet, you may want to get your history in whatever format you wish to have it before May 31. If you use your statements, those will be available in the new online banking.

What does this merger mean for members?

More branch locations: We will have a combined total of 15 branches to serve all our communities and members.

The same knowledgeable, friendly employees: All employees from both credit unions will continue to serve our membership, with many being given more opportunities to grow their skills and careers.

Expanded membership: Effective January 1, 2024, our qualifying field of membership will include anyone who lives, works, worships, or attends school in the state of Michigan.

Products and services: Together we will be able to meet and exceed our members’ expectations better than anyone else, providing enhanced products, services, and digital access to members.

About TRUE Community Credit Union

Like Parkside, TRUE is a financially strong, safe, member-focused, and community-minded credit union. Most importantly, TRUE CCU operates by values very aligned with our own. TRUE has twelve branches throughout Jackson, Washtenaw, and Ingham counties. Please visit TRUE Community Credit Union for more information.

{endAccordion h2}